Shop and Enroll in Individual and Family Plans

Shopping and enrolling in a plan on the website saves time, and it's more convenient than calling us at a specific time. You can shop and enroll in plans any time during your Open Enrollment or when you have a Special Enrollment Period. There's no need to schedule an appointment with a Via Benefits licensed benefit* advisor. If you'd like to shop for plans on the website and then speak with a benefit advisor to enroll, that's okay, too. After you’ve signed in, select Speak to an Expert from the Help and Support drop-down list to schedule a call with a benefit advisor.

You can stop during this enrollment process if you need to. When you come back, you have the option to continue the application where you left off (as long as your enrollment deadline hasn't passed).

If you're renewing a plan and would like to change who's covered by the plan, please call us at 1-866-322-2824 (TTY: 711). This includes things like editing your household or enrolling family members in different plans from each other. Read Keeping Your Marketplace Plan for Next Year to learn more.

To begin shopping for a plan, complete the following steps:

1. Sign in to Via Benefits if you haven't already.

2. Select Shop for Plans in the Shop & Compare section of the Home page.

3. Select:

The person who needs a plan

Where you’re shopping, if applicable

Individual and Family Plans

4. Select:

Any other household members the plan should cover, and why you're shopping today.

Your answer to the tobacco use question.

Why you are shopping.

Note: If it's outside the Open Enrollment Period (OEP), select I'm losing group coverage, had a life-changing event, or need to enroll outside of the annual Open Enrollment Period.

5. For Special Enrollment Periods (SEPs), select the correct enrollment reason from the options listed.

Note: The step to add supporting documentation is not required. It's provided for your convenience to speed up your application process. If you select this enrollment reason, your carrier will need supporting documentation before you can enroll in a new plan.

Add supporting documentation.

Select the type of supporting documentation from the drop-down list. For example, COBRA Notice of Eligibility Letter.

Choose Select File and select the file from your computer.

Select Upload.

Enter the date of your SEP and select Save (required).

Note: You can upload your supporting documentation later from the Your Documents tab of your Profile page.

6. Continue providing your information.

Select when your coverage should start.

Select Save and Continue.

7. Select Prepare to Shop if you're not ready to make your funding decision.

Note: The Your Funding Decision page displays only if your employer or benefits provider is offering you funding. Go to the Funding Decision section of this article to learn more.

8. If you have an existing plan, select whether or not you want a personalized recommendation, and select Next.

Note: If you don't have an existing plan, you’ll be taken to step 11.

9. Select the answers to the questions about the plan you had last year, and select Next.

Note: If you answer No to any of the questions, you’ll be taken to step 11.

10. Select Next.

11. Select + Add Providers to select the types of providers you see regularly.

Answer the health questions. The questions are optional and can be skipped. Providing this information helps us select plans that meet your needs and more accurately estimate your out-of-pocket costs. This does not affect your ability to enroll in a plan.

Note: This step will repeat if you’re shopping for more than one person.

12. Select Next or Skip. If you skip this section, you'll be taken to step 15.

13. Verify your health summary, select Next.

Note: You can select Update Your Answers to make changes.

14. Review the plan recommendations, select Next.

15. Depending on your situation, you may be presented with the option to Shop Private Plans or to Shop Marketplace Plans.

Select how you want to shop for your plan:

For instructions to shop for a Marketplace plan, go to the Shop Marketplace Plans section of this article.

For instructions on how to shop for a Private plan, go to the Shop Private Plans section of this article.

Choosing Between a Marketplace Plan and a Private Plan

Marketplace Plan Facts

If you qualify for, and choose to take, the Premium Tax Credit (PTC), you must enroll in a Marketplace plan.

If you qualify for, and choose to take, a Cost Sharing Reduction (CSR), you must enroll in a Marketplace Silver plan.

You can still choose to use your funding (if offered by your employer) as long as you don't accept the PTC or CSR.

Private Plans Facts

You can't qualify for PTC or a CSR with a Private plan.

Private plans may have less expensive Silver plan premiums compared to Marketplace plans.

Some Private plans may have a broader network than a similar plan offered via the Marketplace.

You can choose to use your funding (if offered by your employer).

Shop Marketplace Plans

To continue shopping for a Marketplace plan, follow these steps:

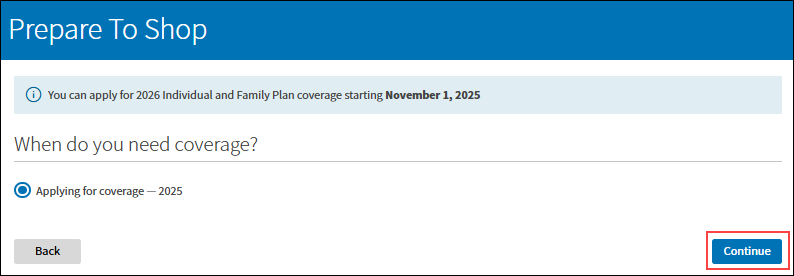

1. Choose when you need coverage, select Continue. If you're currently enrolled in a plan, you will see your current plans. You can select View Plan Details to review your application and edit your information.

Note: To continue an application, follow the onscreen instructions.

2. Select the Primary Contact and review the page. Select Continue if everything's correct.

Note: To make changes, navigate to the Profile page using the Menu at the top of the page. Make your changes and select Save. Select Go to Shop for Plans to return to shopping.

3. Provide information about Who needs health coverage, select Continue.

Note: You can add your spouse and dependents here.

4. Provide Your household information, select Continue.

5. After entering your estimated income, an estimated savings per month appears. If you previously selected employer funding, these savings don't apply to you. This is the estimated Premium Tax Credit (PTC) amount. Select Continue.

6. If it's outside the Open Enrollment Period (OEP), select your qualifying event for your Special Enrollment Period, select Continue.

7. Select How much healthcare you think you’ll use, and select Continue.

8. Add your preferred doctors, pharmacies, and hospitals. You can skip this step if you prefer.

9. Add your prescription drugs. You can skip this step if you prefer.

10. You're presented with the Most affordable plan based on the information you provided.

Note: You can also filter the plans by Lowest premium or view All plans.

This page provides some basic information about the plan, such as the deductible amount, out-of-pocket max, and copays. Select View plan details to learn more about the plan.

11. Select Enroll in this plan if you want to enroll in this plan. You'll be taken to the application.

Note: The lower Monthly premium shown on this page is when using the Premium Tax Credit (PTC). If you chose employer funding, this discounted premium doesn't apply to you. When you select Enroll in this plan, the premium corrects itself.

12. When viewing All Plans, you can use various filters on the left side of the page to narrow plan results. Each plan provides a summary of the coverage, including the plan name, network, metal level, monthly premium, deductible, out-of-pocket max, and copays, etc.

13. Select Enroll now when you're ready to enroll in a plan. You'll be taken to the application.

Note: The lower Monthly premium shown on this page is when using the PTC. If you previously chose employer funding, this discounted premium doesn't apply to you. When you select Enroll now, the premium corrects itself.

14. Agree to the privacy statement by selecting both boxes and the Applicant Signature. Select Continue.

15. Confirm the Primary contact information, select Continue.

16. Confirm your Household information, select Continue.

Notes:

You can add or remove applicants here.

If you took employer funding, you don’t want to see cost saving.

17. Complete the Members section. Enter and select the appropriate answers, and select Continue.

18. On the Additional questions page, select Continue during Open Enrollment. Outside Open Enrollment, check the appropriate boxes and enter additional information.

Note: Retired participants may have a retiree HRA. Some participants are actively employed and receive money from their employers to get a health plan. This is called an Individual Coverage Health Reimbursement Arrangement (ICHRA).

19. You can edit your information on the Finalize page. Once you have verified everything is correct, select Continue. This is your last chance to edit your responses

20. You need to Agree or Disagree with each statement, sign your name exactly as it appears on the application, and select Continue.

21. Review eligibility results. Select Download Eligibility Letter (required) and select Review plan.

22. Confirm your plan. Select Enroll in this plan.

23. Your application is securely submitted to the Marketplace.

24. You've chosen a plan. Review the next steps:

Log in to your dashboard to submit documentation requested by the Marketplace (e.g., proof of citizenship, finances, proof of identity).

Wait for a notice with the results of the Marketplace's review of your documents.

Make your first month's premium payment (binder payment).

Shop Private Plans

To continue shopping for a Private plan, follow these steps:

1. A page appears with all available Private plans from which you can choose. On this page you can:

Update providers and prescriptions by selecting Edit next to the corresponding item in the Your Health Information section on the left side of the page.

Narrow the results by selecting filters in the Coverage Details section on the left side of the page.

Sort plans by Recommended or Premium amount.

Update family members that the plan should cover by selecting Change Who You're Covering.

Compare up to three plans by selecting Compare on the plan tile.

View which doctors or drugs a plan covers by selecting Your Providers or Your Prescriptions on the plan tile.

2. Once you choose a plan, select Add to Cart.

Note: If you didn't select an SEP, you will see this message and be taken back to the beginning of the process to select one.

3. Select the shopping cart icon and then Go to cart to view your plan in the Shopping Cart.

4. Confirm and review your selection, select Start Checkout.

Note: If you want to change plans, select Remove Plan. Then select Continue Shopping.

5. You may get a message to Apply by Phone. Some plans require you to call us to complete your application. You may call us at your convenience or schedule a call.

6. If you're not required to call us, select Go to Application.

7. Review the information for everyone on the application, select Next.

8. Answer the Applicant Questions for each person the plan will cover, select Next.

9. Answer the Household Questions, select Next.

10. Read the Disclaimer and agree to the terms and conditions. Select Next.

11. Enter your Full Name, City, and State, and select Submit Application.

12. On the Application Submitted page:

Verify the Requested Coverage Start Date and note the Via Benefits Confirmation Number.

Review the upcoming expectations. If required, make the initial premium payment.

Select Close.

Once you receive your new plan information, contact the old plan's carrier to coordinate its end date with the new plan's start date. Failure to do so may result in the payment of two premiums. Call us if you need additional assistance.

13. View your selected plan by selecting View My Coverage on the Home page.

Funding Decision

1. The Your Funding Decision page displays if your employer or benefits provider is offering you funding.

Note: You can only accept your reimbursement arrangement (if offered by your employer) or use the Premium Tax Credit (PTC), not both. Please call us if you need help determining if you qualify for the PTC.

2. Select Make Decision if you'd like to make your funding decision.

Select your decision. (You’re deciding whether to opt in and accept your reimbursement arrangement or to opt out and decline it.)

Select Submit.

Note: Once you've made your funding decision, this page no longer appears here. However, Your Funding Decision remains on your Home page until your decision period ends.

3. Select Prepare to Shop if you'd like to shop without making your funding decision.

*Our licensed benefit advisors specialize in health insurance for retirees. They go through annual training and certification to ensure they can help you make an informed and confident decision.